Gold’s Record-Breaking Rally: What It Says About the Global Economy in 2025

Gold is having a gangbusters year — and that’s often a red flag about the world’s financial health.

This week, gold prices surged past $4,000 an ounce for the first time ever, marking a new record and fueling predictions that the rally is just beginning. On Wall Street, investors are split: is this the start of another golden age — or a warning sign that global markets are flashing red?

Why Investors Are Rushing to Gold

Gold has always been the go-to safe haven during times of economic uncertainty, inflation, or geopolitical stress.

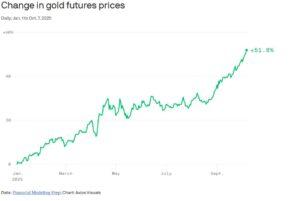

So far in 2025, gold is up over 54%, according to FactSet — on pace for its best year since 1979, when the U.S. battled double-digit inflation and an energy crisis. Historically, gold surges when the world feels on edge — after major crises like 9/11, the 2008 meltdown, or the pandemic.

But what’s unique about today’s spike? It’s happening alongside a booming stock market.

Gold and Stocks: Unlikely Partners in 2025

While investors remain captivated by the AI-fueled rise of Big Tech, they’re also hedging against potential economic turmoil by buying gold.

“The stock market and gold are marching to the beat of two very different drummers,” said David Kotok, co-founder of Cumberland Advisors.

This paradox — stocks soaring while gold climbs — underscores investors’ mixed emotions: optimism about technology, but deep unease about inflation, tariffs, and political uncertainty.

Global Demand and De-Dollarization

The rally is being powered by surging global demand.

As inflation remains above 2%, trade wars escalate, and the U.S. dollar weakens, both individual and institutional investors are fleeing to assets not tied to any one government.

“Global resilience has not yet been fully tested,” IMF Managing Director Kristalina Georgieva warned this week. “There are worrying signs the test may come. Just look at the surging demand for gold.”

Central banks, too, are hoarding gold — a trend that accelerated after Western nations froze Russia’s foreign-held assets in 2022. Those sanctions raised an uncomfortable question worldwide: where is it truly safe to keep money?

The Dollar’s Decline and Shifting Confidence

This year, the U.S. dollar has fallen over 9% against other major currencies — one of its worst performances in decades.

That decline signals eroding confidence in the dollar as the world’s reserve currency, a trend that’s fueling the “de-dollarization” narrative.

Ken Griffin, billionaire investor and Citadel founder, calls it “really concerning” that investors now view gold as a safer bet than the U.S. dollar.

“We’re seeing substantial asset inflation away from the dollar,” Griffin told Bloomberg, “as people look for ways to effectively de-dollarize.”

Expert Insights: What’s Driving the Gold Rush

Economists and strategists agree that multiple forces are behind the surge:

-

Central Bank Buying: Foreign central banks are diversifying reserves away from the dollar.

-

Speculation: Rising prices attract speculators, amplifying the rally.

-

Weak Competition: Treasuries no longer offer compelling yields, leaving “no alternative to gold.”

-

Uncertainty: Concerns about inflation, debt, and U.S. political stability are pushing investors “outside the financial system.”

Still, not everyone believes it’s pure de-dollarization. JPMorgan’s Jay Barry points to continued foreign demand for U.S. Treasuries as evidence of lingering trust in American markets.

What It All Means for Investors

The rally in gold reflects a deeper truth: investors are diversifying away from dollar-denominated assets amid doubts about global stability and U.S. fiscal leadership.

If the price of gold continues to climb, it may not just be a bullish signal for the metal, but a warning about the world economy’s underlying fragility.

Should You Invest in Gold Right Now?

With gold prices at record highs, many wonder whether it’s too late to enter the market. The answer depends on your risk tolerance and long-term goals.

Gold remains a powerful hedge against inflation and volatility, but it can also be highly cyclical. Investors should consider diversifying their portfolios with a mix of assets, including precious metals, equities, and fixed income — ideally with guidance from a professional advisor.

Don’t Wait to Protect Your Wealth

Gold’s surge is more than a headline — it’s a signal.

Now is the time to review your portfolio and ensure you’re prepared for the next phase of global volatility.